- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Washington

- West Virginia

- Wisconsin

- Wyoming

How To Search Virginia Business Entities

- Uncover In-Depth Information on Business Entities

- How To Find the Owner of a Business Entity in Virginia?

- Why Conduct a Virginia Entity Search?

- Who Holds Data for Virginia Business Entity Search?

- What Entities Can You Register in Virginia?

- How Do I Check If a Business Entity Name is Taken in Virginia?

- How Do I Set Up a Business Entity in Virginia?

- How Much Does It Cost To Start a Business In Virginia?

- Additional Information Available on the Virginia Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Virginia

There are over 209,000 registered business entities in Virginia. On average, over 34,000 business entities are registered annually in the state. Small businesses account for over 93% of new business filings with over 32,000 entities. Businesses in Virginia typically fall under corporations, partnerships, LLCs, business trusts, and nonprofit business types. The Commonwealth of Virginia State Corporation Commission’s website serves as a reliable and up-to-date source for conducting business entity searches.

Business entity searches provide insights into the legal standing and status of an entity. Entity searches help detect potential fraudulent businesses. Furthermore, entity searches provide crucial information to investors before they invest their funds.

Choose Your Search Criteria

- Entity Name:

Search by the full or partial name of the business.

- Entity ID:

The seven-digit number issued after registration.

- Principal Name:

Search by the first or last name of the registered individual or organization.

- Registered Agent Name:

The individual or business appointed to receive official documents.

- Filing Number:

The number used to track the entity’s submitted filings.

Review Search Results

Virginia business entity search results display information matching the search criteria, including entity ID, entity name, name type, entity type, principal office address, registered agent’s name, and status of the business.

Further Assistance

If you need help accessing business entity records, you may contact the Commonwealth of Virginia State Corporation Commission’s office.

How To Find the Owner of a Business Entity in Virginia

- Public Records

Public records, such as tax records, real estate records, and court records, may include information on business entity owners.

- Better Business Bureau (BBB)

The BBB provides information on credible businesses in Virginia and may sometimes include owner details.

- Virginia Public Libraries

Some public libraries maintain business directories and databases, which may include business ownership information.

Why Conduct a Virginia Entity Search?

A business entity search verifies registration and standing, ensuring consumer confidence.

Investors can review structure, ownership, and legal status before committing funds.

Entity searches confirm that suppliers are compliant and trustworthy partners.

Inconsistencies or missing data in official records may help detect scams or unregistered businesses.

Who Holds Data for Virginia Business Entity Search?

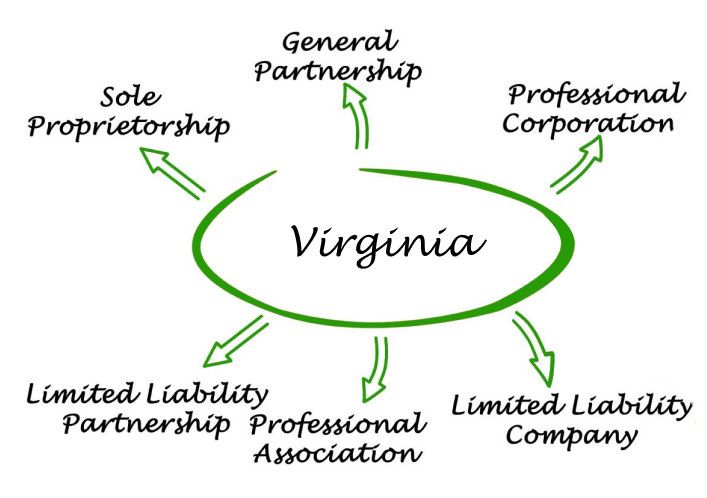

What Entities Can You Register in Virginia?

A corporation is a legal entity separate from its owners. Virginia recognizes two types of corporations:

- C Corporations

Members are not personally liable for the company’s debts. Subject to double taxation at both corporate and shareholder levels.

- S Corporations

Avoid double taxation by passing profits and losses to shareholders, who report them on personal tax returns.

LLCs offer limited liability protection and avoid double taxation by passing profits through to members’ personal tax returns.

Formed by two or more people, general partnerships share profits, liabilities, and management responsibilities equally.

General partners manage the business and have full liability, while limited partners invest and have limited liability.

All partners participate in management, but they are protected from the negligence of other partners and certain liabilities.

A legal arrangement where trustees manage the business on behalf of beneficiaries. Trustees are not personally liable for debts.

A business owned by one person, where the owner is personally liable for debts. Income is reported on the owner’s tax return.

Created for charitable, religious, or educational purposes. Profits are reinvested and entities may apply for tax-exempt status.

Formed by licensed professionals such as lawyers or doctors. PCs offer liability protection, except in malpractice cases.

How Do I Check If a Business Entity Name Is Taken in Virginia?

How Do I Set up A Business Entity in Virginia?

- Choose your business structure: sole proprietorship, partnership, corporation, or nonprofit.

- Select a business name using the Name Check Availability tool.

- Designate your registered agent.

- File formation documents online.

- Register with the Virginia Department of Taxation.

- Obtain an EIN from the IRS.

- Submit BOI (Beneficial Ownership Information) to FinCEN.

How Much Does It Cost to Start a Business in Virginia?

Business startup costs vary by entity type. Common fees include:

- LLCs & Business Trusts

$100 filing fee

- Non-Stock Corporations & Nonprofits

$75 filing fee

- Stock Corporations

$50 per $25,000 shares; up to $2,500 for 1 million shares

- Partnerships, LLPs, LPs

$25–$100 depending on type

- Annual Fees

$25 for non-stock corps, $50 for others

Additional Information Available on the Virginia Corporate Commission Website

- Business Homepage

Guidance for starting and managing your business.

- Forms and Fees

Registration documents and costs by entity type.

- Start a New Business

Step-by-step setup instructions.

- Online Help

Manage, close, or amend business filings.

- FAQs

Common questions answered for Virginia businesses.

FAQs About Business Entity Searches in Virginia

- Why would I need to search for a business entity in Virginia?

To verify if a business is active, in good standing, or a safe investment.

- What types of entities can I search for in Virginia?

Corporations, LLCs, partnerships, LLPs, nonprofits, and business trusts.

- Where can I perform a business entity search in Virginia?

Use the Business Entity Search tool.

- What information do I need to conduct an entity search in Virginia?

Business name, entity ID, principal name, registered agent, or filing number.

- How do I find the official name of a Virginia business?

Use the Business Entity Search page.

- Can I search for foreign entities in Virginia?

Yes, foreign entities conducting business in Virginia can be found via search.

- What information can I find in the Virginia entity search?

Status, filings, registered agent info, and ownership structure.

- How do I verify if a Virginia business is in good standing?

Use the Clerk’s Information System.

- Can I search for an entity in Virginia by its owner’s name?

Yes, the tool supports owner name-based searches.

- How often is the Virginia business entity database updated?

The database is updated daily.

- Can I obtain copies of business filings in Virginia?

Yes, via the Clerk’s Information System.

- How do I find out who the registered agent of a Virginia business is?

Search results include registered agent details.

- How can I search for Virginia businesses by their tax ID number?

This option is not available through the state's search tools.

- What should I do if I can’t find a business entity in the Virginia search?

Verify the name and try alternative spellings or use advanced search options.

- Uncover In-Depth Information on Business Entities

- How To Find the Owner of a Business Entity in Virginia?

- Why Conduct a Virginia Entity Search?

- Who Holds Data for Virginia Business Entity Search?

- What Entities Can You Register in Virginia?

- How Do I Check If a Business Entity Name is Taken in Virginia?

- How Do I Set Up a Business Entity in Virginia?

- How Much Does It Cost To Start a Business In Virginia?

- Additional Information Available on the Virginia Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Virginia